3 financial tips for students

In many cases, university studies are synonymous with debt. Not only because of the university investment per se but also because you must factor in daily expenses and rent if you are studying away from home.

This is why it is crucial to managing the money you have, especially if you are in the middle of your studies.

These tips will assist you in improving your financial habits, as well as working on cleaning up your finances, which is always appreciated no matter what stage of life you are in. And, of course, having behaviors that allow you to protect your assets while maintaining good financial health is always a win-win situation.

We offer three suggestions to help you improve your finances:

1. Set a Budget.

Setting a budget will assist you in planning how to manage your finances. Allocate different amounts of money based on your needs. This habit will allow you to keep track of what you spend your money on, where you spend it, and when you spend it.

It is vital that you stick to your budget and seek to maintain your expenses under control at all times.

Making your own coffee instead of going to a coffee shop and using the free version of Spotify will help you keep your finances in check.

When it comes to spending control, don't forget to keep track of how much money you spend.

Another item that, if possible, should be incorporated into your monthly budget is the creation of a small cushion for unexpected expenses that may arise along the way.

2. Create a payment plan for your debts

If you have debt, you should have a plan in place to pay it off. To pay them off, look into amortization plans.

Also, don't forget to include the amount of money you spend on debt payments in your monthly budget.

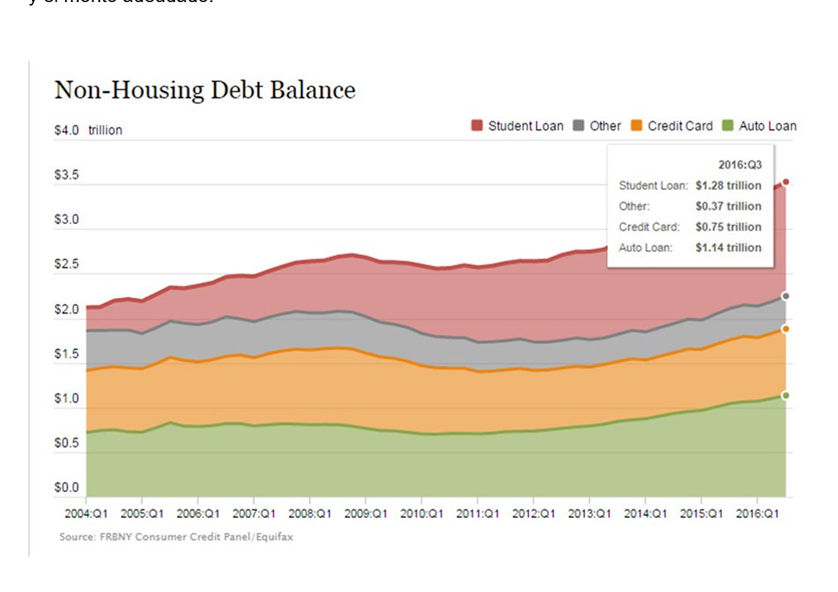

Only in countries with a stable economy, such as the United States, is it estimated that 7 out of 10 final-year university students graduate in debt. Furthermore, it takes an average of 19.7 years for American students to repay their student loans.

According to statistics, more than 45 million Americans currently have student debt. That means that a quarter of the adult population in the United States owes an average of $34K in loans.

3. Start investing.

An excellent idea is to begin investing wisely in order to accumulate future capital. Begin with a small budget; the important thing is to enter the world of finance and gradually learn about it. You can also do this with the help of experts in the field, who will advise you on how to spend your money wisely.

Remember that this will pay dividends in the long run, so invest money that is not intended for another activity or goal.

Monitoring your finances is a lifelong habit that will help you live a financially peaceful life. Make it a point to incorporate these habits into your daily routine.

It is also important to look for study options that fit your budget, availability of time, and, why not, that allow you to stay in your city while gaining international experience. Because of the portability that the internet provides, the options for obtaining higher education are now limitless.